I read something in the news yesterday that blew my mind.

A sweater just sold for $1.1 million.

It’s a wool sweater, the kind you’d wear to a tailgate party, or to go apple picking, or to get a laugh at your company’s “ugly” Christmas sweater party.

More than a million bucks for a sweater?

What’s going on here? And how can you get in on the action?

Warm & Wonderful

The sweater in question was created by the brand Warm & Wonderful, which was founded in the 1970s by Joanna Osborne and Sally Muir.

Here’s what it looks like:

Hmm. A red sweater decorated with a few dozen white sheep and one black sheep.

Look familiar?

I’ll give you a hint:

It was worn by a famous member of the British royalty.

Ding ding ding! That’s right. It was worn by Diana, Princess of Wales.

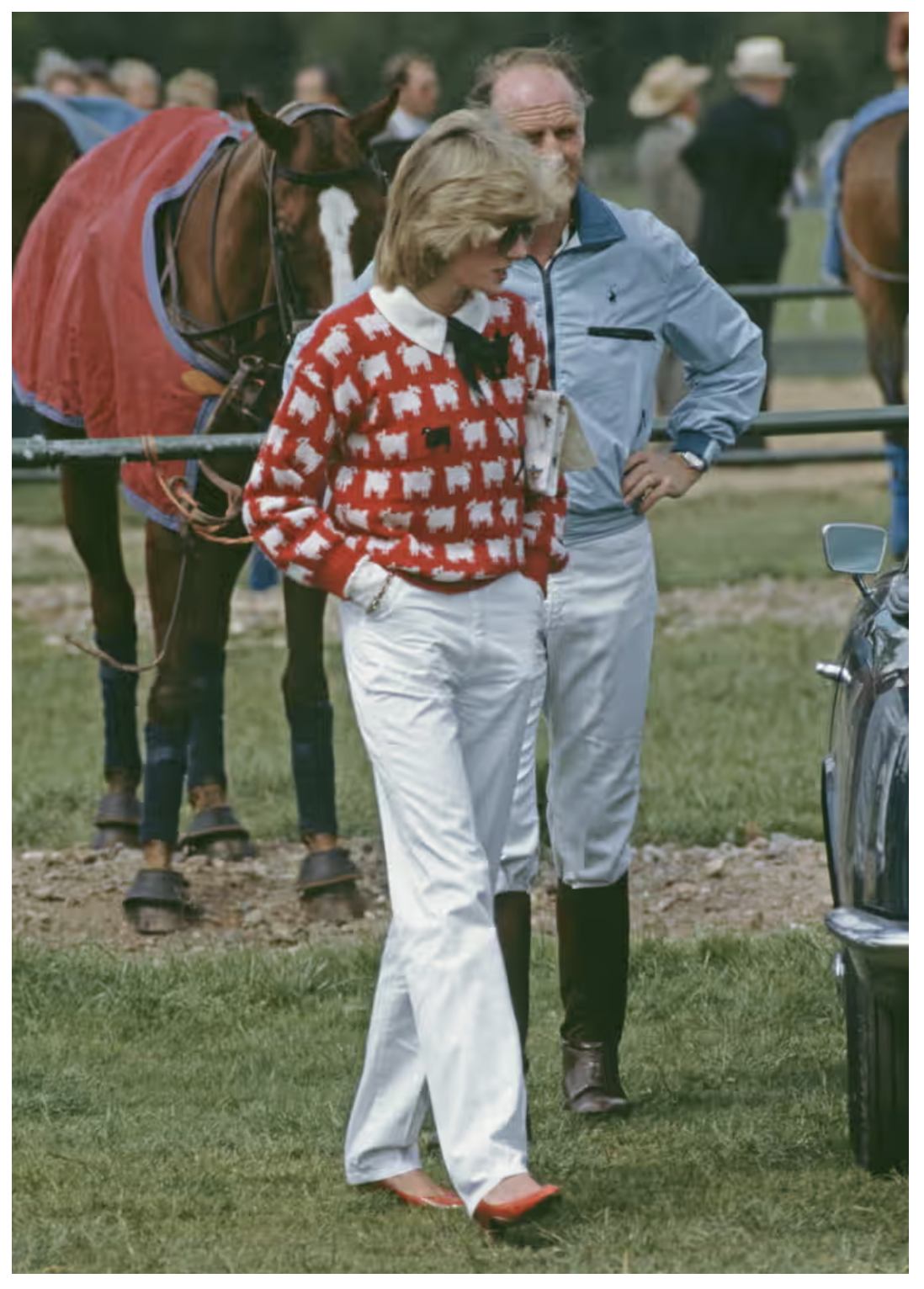

Here’s a photo of her wearing it:

The thing is, the sweater in the picture above was a replacement.

You see, about a month after Diana wore it for the first time, Osborne received a letter from Buckingham Palace saying it had been damaged. It’s not every day you receive a letter from Buckingham Palace. As Osborne tells it, “We were rather appalled, so we immediately replaced it.”

For decades, it was believed the original sweater had been lost.

But in March of 2023, Osborne came across it while she was cleaning out her loft — and she quickly put it up for auction…

The Most Valuable Sweater Ever Sold at Auction

The venerable auction house Sotheby’s handled the sale of the sweater.

Prior to the sale, Sotheby’s estimated it might fetch $50,000 to $80,000.

But nowadays, with so many investors turning to “collectibles” like this one as an alternative to stocks and bonds…

Perhaps the sale price of more than $1 million was inevitable.

Let me explain.

An Alternative to Stocks and Bonds

To kick things off here, let me summarize how most people invest:

Most folks stick with stocks, bonds, and ETFs. If they’re really adventurous, maybe they’ll add some bitcoin.

But the rich invest differently. And this difference might explain why they keep getting richer.

You see, according to recent research from Motley Fool, the rich mainly invest in “alternative assets.” What are these alternatives? For starters, they include private startups and private real estate deals — the kind we focus on here at Crowdability.

But they also include collectibles like art, baseball cards, and you guessed it, clothing.

As of 2020, the wealthy held about 50% of their assets in these alternative investments, and just 31% in stocks. The remainder was in bonds and cash.

Why would they do such a thing? Let’s take a look.

Three Reasons the Wealthy Invest in Alternatives

For starters, investing in alternative assets provides diversification. So even if the stock market is crashing, these assets can keep growing in value.

Furthermore, they offer a hedge against inflation. In inflationary times like we’re in today, that’s a valuable trick.

But perhaps most important of all, they can provide market-beating returns.

For example, over the last 25 years, early-stage startup investments have delivered annual returns of 55%. That’s about 10x higher than the historical average for stocks.

And meanwhile, according to the Motley Fool, over the last decade:

- Wine has shot up 127% in value.

- Classic cars have gone up 193%.

- And rare whisky is up an astonishing 478%.

So, how can you get in on the action — before these items become so valuable, and for just hundreds of dollars instead of millions?

Investing in Collectibles

Recently, a new type of website has emerged to give ordinary people the ability to invest small amounts of money into everything from fine wine to fine art.

Essentially, just like you can buy a $100 stake in a startup, now you can buy $100 worth of a vintage Bordeaux, a classic piece of art from Keith Haring, or a multi-million-dollar sweater, dress, or sneakers used by a celebrity like Princess Di.

For example, on Otis, you can invest in collectibles including baseball cards, limited-edition sneakers, art, and watches.

And on Rally Rd, you can find everything from vintage Porsches to one-of-a kind offerings like the double-necked guitar used by Slash from Guns N’ Roses. It also offers a secondary market, so you can aim to sell your investments at any time.

You can invest whatever you’re comfortable with — $100 here, $100 there — and when the item sells, you receive your profits in relation to how much you put in.

Watch Out!

Keep in mind, all the typical caveats about investing apply here:

For example, don’t invest more than you can afford to lose; invest in what you know; and be sure to dip your toe into the water before diving in.

Furthermore, many alternative investments aren’t entirely “liquid.” That means they can’t necessarily be converted into cash at the snap of your fingers.

So don’t invest your rent or grocery money into these offerings.

But if you’re looking to invest like the rich — or even if you’re just looking for an “ugly” sweater to wear to this year’s holiday party — platforms such as Otis and Rally can be a great place to start.

Happy Investing.

Best Regards,

Founder

Crowdability.com